Hjelp Expenses that qualify The renovation expenses that you can claim must be qualifying expenditures A qualifying expenditure is all of the following A reasonable expense that is directly attributable to the

You can also deduct expenses you had for bookkeeping services audits of your records and preparing financial statements You may be able to deduct fees and expenses for advice and help to prepare Determine the types of purchases and expenses The amount you can recover for any expense depends if it is considered an operating expense or a capital expense

Hjelp

Hjelp

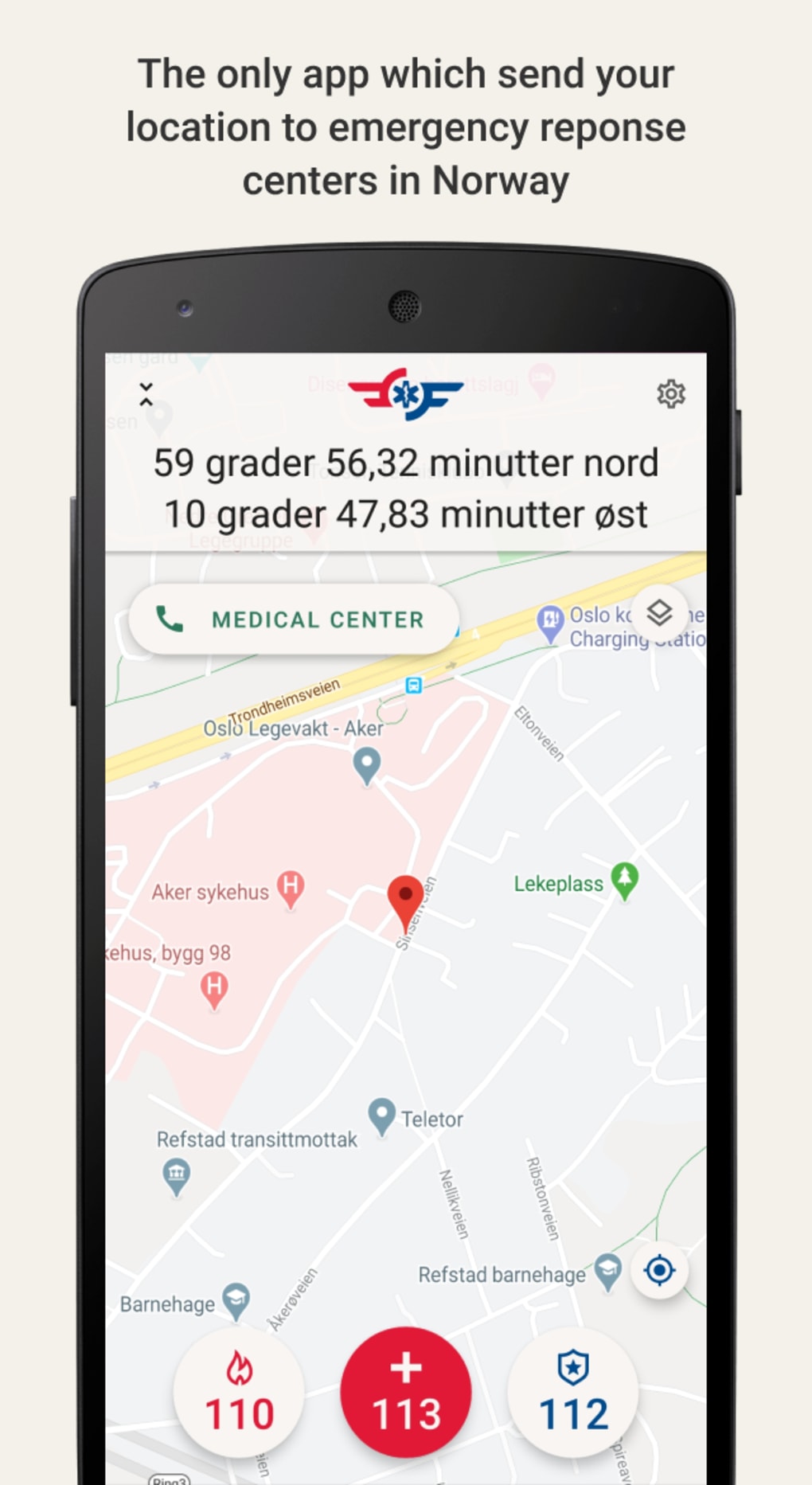

Hjelp 113 Pour Android T l charger

.webp)

Hjelp Med Mobbing Stiftelsen Rettferd

Go to Home office expenses for employees for more information You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses You cannot Expenses section of form T2125To determine whether the income you earned from a short term rental is from a property or business consider the number and types of services you provide for your tenants

Personal income tax Claiming deductions credits and expenses Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit rates that will apply in 2025

More picture related to Hjelp

Hjelp Til Stemme P Skal Vi Danse Innhold TV 2 Hjelp

Beregn Nettol nn Ved Hjelp Av Microsoft Excel Hvordan Apne Blogg

Ronaldos Trump hjelp Mer Respekt

Find out which deductions credits and expenses you can claim to reduce the amount of tax you need to pay How to claim eligible medical expenses on your tax return You can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax

[desc-10] [desc-11]

Dette Er Nytt I Hjelp 113 appen Norsk Luftambulanse

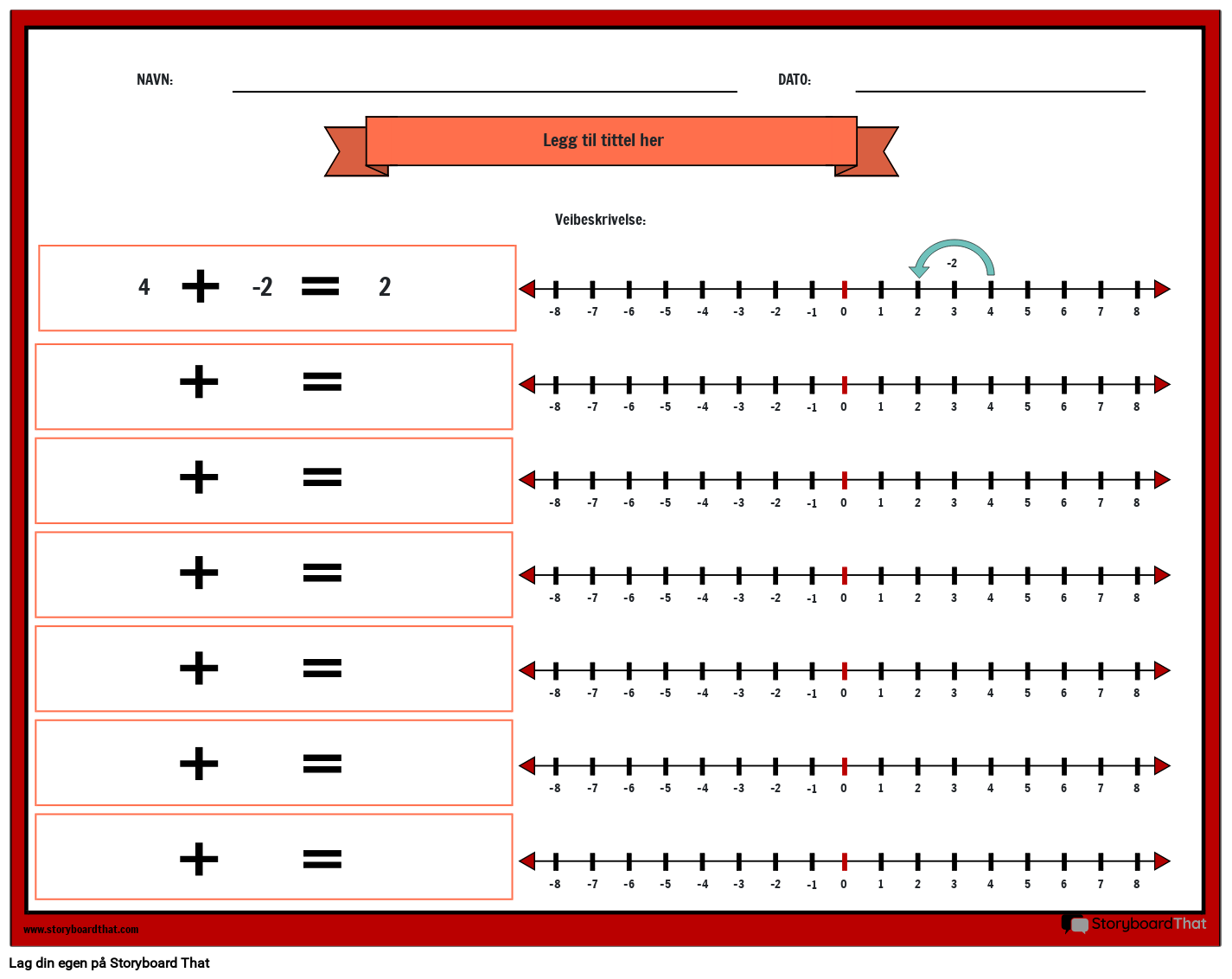

Legge Til Heltall Ved Hjelp Av Talllinje Storyboard

https://www.canada.ca › ... › expenses-claim-mhrtc.html

Expenses that qualify The renovation expenses that you can claim must be qualifying expenditures A qualifying expenditure is all of the following A reasonable expense that is directly attributable to the

https://www.canada.ca › en › revenue-agency › services › tax › businesses › t…

You can also deduct expenses you had for bookkeeping services audits of your records and preparing financial statements You may be able to deduct fees and expenses for advice and help to prepare

Riktig Hjelp Til Riktig Byr d Sunniva Holm s Eidsvoll

Dette Er Nytt I Hjelp 113 appen Norsk Luftambulanse

Sender 31 Stridsvogner Ukraina Trenger Hjelp Til Forsvare Seg

Israel Palestina Huitfeldt Snakket Med Israel topp Ba Om Hjelp

Hvordan Laste Ned Websider Og Filer Ved Hjelp Av Wget Hvordan Apne Blogg

Kunstig Intelligens KI Til Hjelp Eller Besv r Erfaringer Fra

Kunstig Intelligens KI Til Hjelp Eller Besv r Erfaringer Fra

Lykkevika NRK TV

Klololo NRK TV

Hjelp Havets Haier Added A New Photo Hjelp Havets Haier

Hjelp - [desc-14]